Cyprus is a small country that is enlisted in the European Union. The turmoil of the euro zone crisis has been in action since long and the latest effects have hit Cyprus real bad and are as if targeted the country. It was basically a crisis that affected the banking business of the country. Last week a bailout of 10bn Euros had been agreed by the IMF and the EU for the curing of the economy. The bailout deal of the country with the IMF and EU has brought many other small economy countries into light. It received €10 billion as the bailout amount on last Monday to combat the present state of crisis. As per the deal, the second largest bank of the country was forced to close as it was found responsible for about 40% losses. The financial condition of the banking sector might now be stable but the problem doesn’t end now as most of the experts predict that some other countries too might get in to a situation they need and demand for a similar bailout. The question arises as which would be that next country?

Jose Manual Barroso, European Commission President, said on last week in Moscow that the unsustainable financial system was the cause for crisis in the country. He added further that this financial system needs to adapt to the conditions and lacks in ability to work through its own ways. Cyprus won’t be the last country in the euro zone to be in need of a bailout as per the Reuters poll. As per the poll, Spain and Slovenia are the countries likely to hit a recession. The capital controls seem to appropriate to stabilize the condition but may not last for more than a few months. Other small economies in the euro zone are expected to come across a similar condition. The big question that arises now is that which would be the next country to face crisis? Below are some suspects along with possible reasons that may drag them to a similar situation.

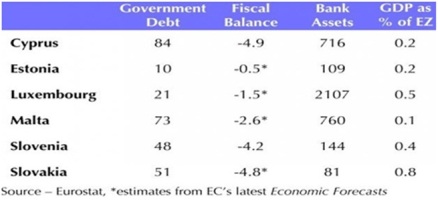

Fiscal Position and Bank Assets in 2012 (%GDP)

Possible Contagion Capturers after Cyprus

Slovenia

The banking sector of Slovenia too is overburdened and the recent Cyprus crisis has brought a disruption in the investors in this country too. As the yield on Slovenia’s 10-year note have leaped greater than 100 basis points in the past week which may account for 6.8% – the highest level since September, the country is expected to experience the market pressure in coming days. Although the banking sector of the country is not so huge, the loans have reached a limit of about 25% of the total assets and this is a really alarming state. The condition of the banks is further expected to sink. The financial condition of the bank is annually checked by the IMF so as to recapitalize them and bring to a level of at least 3 percent GDP. The future estimated market condition zooms in a view where a loan (a bailout) from the European Central Bank or European Commission might be required.

Malta

The financial services of the country are eight times of its GDP. This was the size of Cyprus and Ireland just before the fall. Josef Bonnici, Governor of central bank, Josef Bonnici said that the major banks of the country amounted below 300 percent of the GDP and this was just normal. He further added that comparing it with the financial state in Cyprus was just something misleading and has no fact behind.

Luxembourg

The bank assets of the country is about 2000 percent of the total GDP and this is the highest of any other country in the European zone. The banking sector of the country is composed of subsidiaries and branches of foreign banks and therefore there might be a need for the mother banks and the government to give support at the time of crisis. A mere 8% of the total bank assets of the country (Cyprus has 71% of it) is held by the domestic banks. Thus it is at a completely different state. The Luxembourg governor issued a two paged statement that clearly states the financial condition of the country that confirms that it is in no way comparable with that of Cyprus.

Estonia and Slovenia

These are two more countries in the euro zone that might be vulnerable to an unstable banking finance. The banks in Estonia are funded by foreign countries and the fiscal position is considered strong enough to combat a tide in future. Being funded by foreign sources, it might be at lower risk of any deep impact of the domestic market conditions. However, it cannot be completely aloof from the effects as some domestic market factors do bring changes in local business. Slovenia owns the smallest banking sector in the euro zone and has performed well enough even during the Euro zone crisis. Being smaller economies, it is expected that the contagion might spread to these two countries after Cyprus.